Feie Calculator for Dummies

Table of Contents6 Simple Techniques For Feie CalculatorThe Ultimate Guide To Feie CalculatorThe smart Trick of Feie Calculator That Nobody is DiscussingGetting The Feie Calculator To WorkThe Greatest Guide To Feie Calculator

First, he marketed his united state home to develop his intent to live abroad completely and applied for a Mexican residency visa with his spouse to aid satisfy the Bona Fide Residency Examination. Additionally, Neil protected a lasting home lease in Mexico, with plans to at some point purchase a home. "I currently have a six-month lease on a house in Mexico that I can expand an additional 6 months, with the purpose to buy a home down there." Nonetheless, Neil explains that acquiring property abroad can be challenging without very first experiencing the area."We'll absolutely be beyond that. Also if we return to the United States for doctor's consultations or organization telephone calls, I question we'll spend greater than thirty days in the United States in any type of provided 12-month period." Neil emphasizes the importance of rigorous tracking of united state sees (Form 2555). "It's something that individuals require to be truly attentive concerning," he states, and recommends deportees to be mindful of typical mistakes, such as overstaying in the U.S.

Some Known Incorrect Statements About Feie Calculator

tax responsibilities. "The reason united state taxes on around the world earnings is such a large bargain is because several individuals neglect they're still subject to U.S. tax also after transferring." The united state is one of the few nations that taxes its citizens regardless of where they live, suggesting that even if a deportee has no revenue from U.S.

income tax return. "The Foreign Tax Credit score enables people functioning in high-tax countries like the UK to offset their U.S. tax obligation responsibility by the quantity they have actually already paid in taxes abroad," claims Lewis. This makes certain that expats are not exhausted twice on the exact same revenue. Nevertheless, those in reduced- or no-tax nations, such as the UAE or Singapore, face added difficulties.

Not known Facts About Feie Calculator

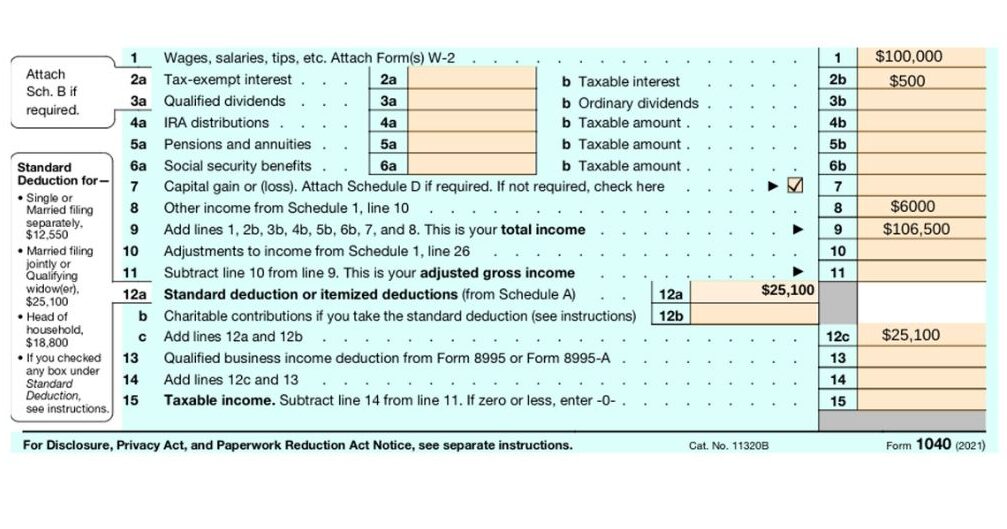

Below are a few of the most often asked questions concerning the FEIE and other exclusions The International Earned Earnings Exclusion (FEIE) permits united state taxpayers to exclude up to $130,000 of foreign-earned earnings from federal income tax obligation, reducing their U.S. tax obligation. To receive FEIE, you should meet either the Physical Visibility Test (330 days abroad) or the Bona Fide Residence Test (show your primary residence in an international country for a whole tax obligation year).

The Physical Existence Test requires you to be outside the united state for 330 days within a 12-month period. The Physical Existence Test also requires united state taxpayers to have both a foreign revenue and a foreign tax home. A tax home is defined as your prime location for business or employment, no matter your family members's residence.

The Feie Calculator Statements

A revenue tax treaty between the U.S. and an additional nation can aid avoid dual taxation. While the Foreign Earned Earnings Exclusion minimizes taxable earnings, a treaty might provide fringe benefits for qualified taxpayers abroad. FBAR (Foreign Financial Institution Account Report) is a needed declaring for U.S. people with over $10,000 in international financial accounts.

Qualification for FEIE depends on meeting particular residency or physical presence tests. He has over thirty years of experience and now specializes in CFO services, equity settlement, copyright taxation, cannabis taxes and separation associated tax/financial planning matters. He is an expat based in Mexico.

The foreign gained earnings exclusions, sometimes described as the Sec. 911 exemptions, exclude tax obligation on earnings go right here earned from working abroad. The exemptions make up 2 components - an earnings exclusion and a housing exemption. The complying with FAQs review the advantage of the exclusions including when both spouses are deportees in a basic fashion.

Feie Calculator Things To Know Before You Get This

The tax benefit excludes the income from tax at lower tax obligation prices. Previously, the exclusions "came off the top" decreasing earnings subject to tax at the top tax obligation rates.

These exclusions do not exempt the wages from United States taxes however simply supply a tax obligation decrease. Note that a solitary individual working abroad for every one of 2025 who earned about $145,000 without any other earnings will certainly have taxed revenue lowered to zero - successfully the same answer as being "tax obligation cost-free." The exclusions are computed on a day-to-day basis.

Comments on “Things about Feie Calculator”